How to use strategies for fixed time trading

Fixed-time trading, also known as binary options trading, involves making predictions about the future price movement of a specific asset within a fixed time frame. Traders have two options: they can either predict that the price of the asset will go up (call) or down (put) within the specified time frame. Here are some strategies you can consider when engaging in fixed-time trading:

Create a Fixed time trading account here for free with demo credit and learn how to earn money using following techniques

Technical Analysis:

Study price charts, patterns, and technical indicators to make informed predictions about future price movements.

Look for support and resistance levels to identify potential entry and exit points.

Utilize indicators like Moving Averages, RSI (Relative Strength Index), and Bollinger Bands to spot trends and overbought/oversold conditions.

Fundamental Analysis:

Examine news, events, and economic indicators that might impact the asset's price.

Understand the asset's underlying fundamentals, such as earnings reports, economic data, and market sentiment.

Money Management:

Implement a risk management strategy. Never invest more than you can afford to lose.

Determine the percentage of your capital to risk on each trade. A common rule is not to risk more than 1-2% of your total trading capital on a single trade.

Time frames:

Fixed-time trading offers various time frames, from seconds to minutes or hours. Choose a time frame that matches your trading style and risk tolerance.

Shorter time frames may require more frequent monitoring, while longer time frames may require more patience.

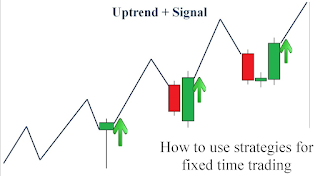

Trend Following:

Follow established trends. If the asset is in an uptrend, consider placing a call option; if it's in a downtrend, consider a put option.

Use trend indicators like Moving Averages and trendlines to identify and confirm trends.

Support and Resistance:

Pay attention to significant price levels. If an asset approaches a strong support or resistance level, it can be a good time to enter a trade.

Breakouts above resistance or below support can provide trading opportunities.

Candlestick Patterns:

Learn to recognize common candlestick patterns, such as doji, hammer, and engulfing patterns, which can signal potential reversals or continuations. Start Trading with Olymp Trade Now

Contact on Telegram for more details +918660927112

Risk-Reward Ratio:

Consider the potential risk and reward of each trade. Aim for a positive risk-reward ratio, where your potential reward outweighs your risk.

Some traders target a 1:2 or 1:3 risk-reward ratio.

Backtesting:

Test your strategies on historical data before applying them in real-time trading. This can help you fine-tune your approach and identify weaknesses.

Emotional Discipline:

Keep emotions in check. Don't let fear, greed, or impulsiveness dictate your trading decisions.

Stick to your trading plan and set clear entry and exit points.

Start Trading with Olymp Trade Now

Remember that fixed-time trading involves a significant level of risk, and there's no guaranteed strategy for success. Always be cautious and consider seeking advice from experienced traders or financial professionals before engaging in this type of trading. Additionally, be aware of the regulations and risks associated with binary options trading in your jurisdiction.

Comments

Post a Comment